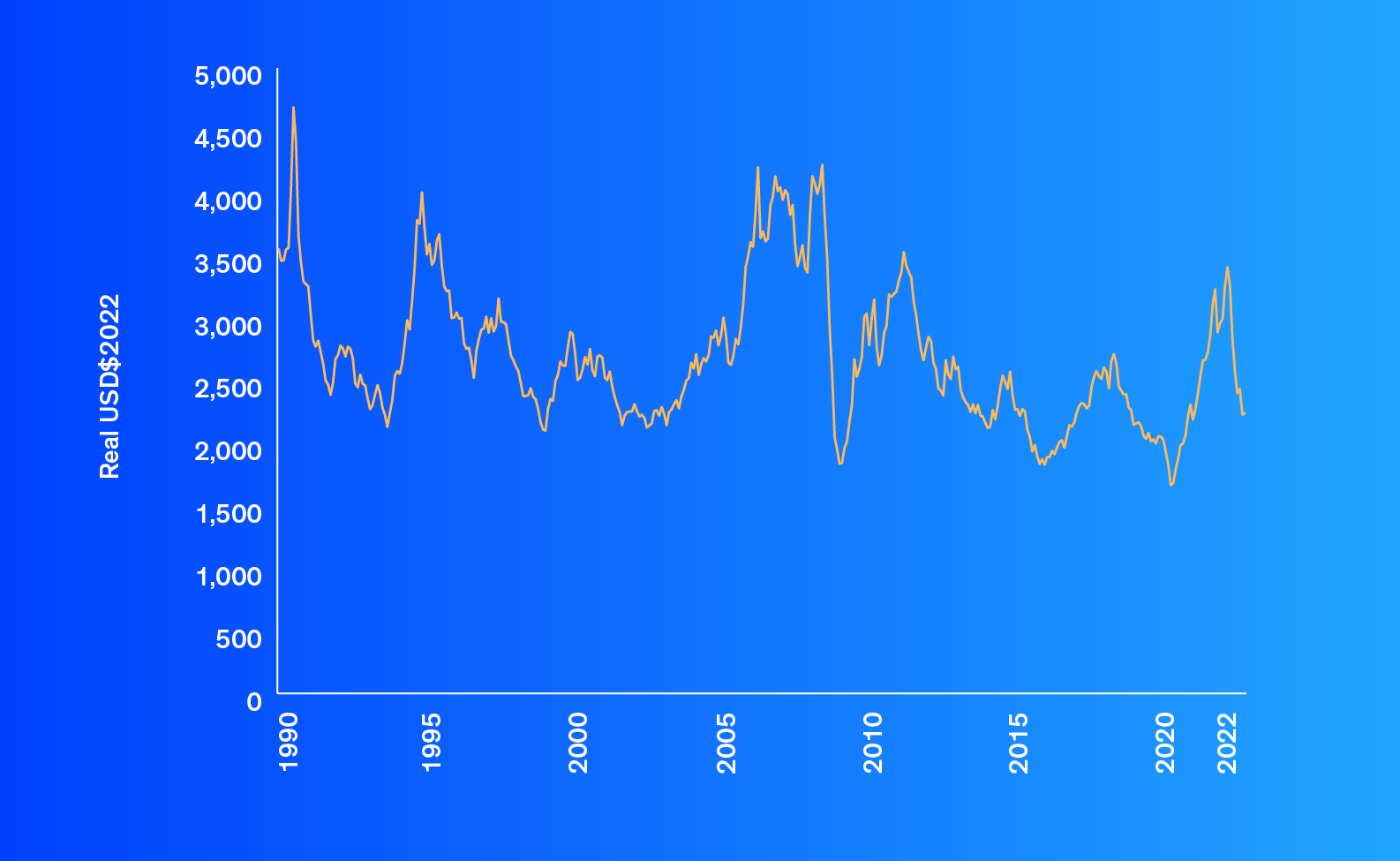

Aluminium: a commodity traded at the LME

The London Metal Exchange (LME) is the global trading centre where industrial metals, including aluminium, are traded. The LME reflects the state of the global market, taking into account inventories and global production data.

The LME price plus a regional premium determines the base price of unwrought aluminium for a given market.

Regional premiums reflect not only regional market balance, but also local market conditions as well as payment terms, applicable tariffs and delivery charges. There are 3 regional premiums: Midwest Premium (North and Central America), CIF MJP Premium (Southwest Asia, Japan/Korea, Middle East) and Metal Bulletin Premium (Europe and Africa).